CM Punjab Loan Scheme 2025 Online Apply – August Registration, Eligibility & Loan Details

The Government of Punjab has officially launched the CM Punjab Loan Scheme 2025 to support young entrepreneurs, small business owners, and skilled individuals in starting or expanding their businesses. This initiative aims to boost economic activity, create jobs, and empower citizens through interest-free and low-interest loans.

Here’s a complete August 2025 guide on how to apply online, eligibility criteria, and loan details.

What is CM Punjab Loan Scheme 2025?

The CM Punjab Loan Scheme 2025 is a government-funded program designed to provide easy financing options for the people of Punjab. The scheme focuses on youth, women entrepreneurs, and low-income families, enabling them to establish sustainable businesses.

Under this scheme, applicants can apply for loans ranging from PKR 50,000 to PKR 10 million, depending on their business plan and category. The scheme is supervised by the Punjab Small Industries Corporation (PSIC) and other relevant departments.

CM Punjab Loan Scheme 2025 – Key Features

| Feature | Details |

|---|---|

| Loan Amount | PKR 50,000 – PKR 10 Million |

| Interest Rate | 0% (Interest-Free) or Low Interest |

| Loan Tenure | 2 – 5 Years |

| Target Groups | Youth, Women, Low-Income Families |

| Application Mode | Online |

| Supervising Authority | Punjab Small Industries Corporation (PSIC) |

Eligibility Criteria for CM Punjab Loan Scheme 2025

Before applying, make sure you meet the eligibility criteria:

- Age Limit: 18 to 50 years

- Domicile: Punjab province only

- Business Type: New or existing business

- CNIC: Valid Computerized National Identity Card

- Skill/Experience: Relevant to proposed business

- No default history in banks or financial institutions

Documents Required for Online Application

Applicants must prepare the following documents:

- Copy of CNIC (front and back)

- Recent passport-size photograph

- Business plan or feasibility report

- Bank account details

- Proof of income (if applicable)

- Domicile certificate

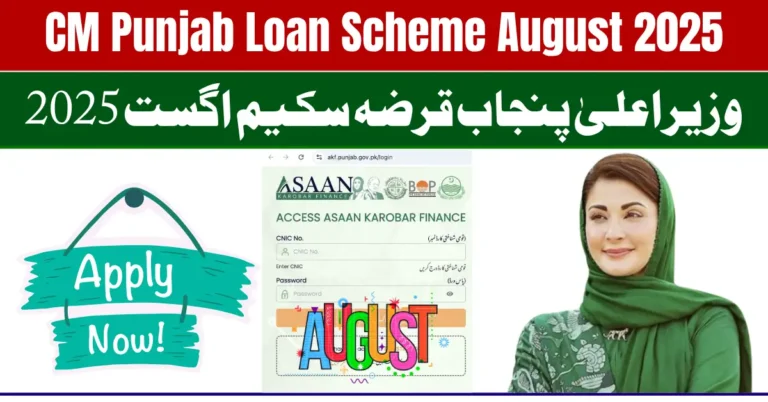

How to Apply for CM Punjab Loan Scheme 2025 Online?

The application process for the CM Punjab Loan Scheme 2025 online apply is simple and user-friendly. Follow these steps:

Step 1: Visit the Official Portal

Go to the Punjab Government loan scheme official website or the Punjab Small Industries Corporation (PSIC) online application portal.

Step 2: Create an Account

Register with your CNIC, mobile number, and email address to create an online profile.

Step 3: Fill the Application Form

Provide your personal details, business information, and loan category.

Step 4: Upload Required Documents

Attach all scanned copies of required documents in JPEG or PDF format.

Step 5: Submit Application

Review your form and click “Submit”. You will receive an application tracking ID for future reference.

Loan Categories in CM Punjab Loan Scheme 2025

| Category | Loan Range | Interest Rate |

|---|---|---|

| Small Loans | PKR 50,000 – PKR 500,000 | 0% Interest |

| Medium Loans | PKR 500,001 – PKR 5 Million | 4% Interest |

| Large Loans | PKR 5 Million – PKR 10 Million | 5% Interest |

Benefits of CM Punjab Loan Scheme 2025

- Easy Access to Financing for small and medium businesses

- Interest-Free Loans for low-income citizens

- Special quota for women entrepreneurs

- No collateral required for small loans

- Online application reduces paperwork and delays

Important Dates – August 2025

- Application Start Date: 1st August 2025

- Last Date to Apply: 31st August 2025

- Loan Disbursement: From September 2025 onwards

Helpline & Contact Information

For more details, applicants can contact:

- Helpline: 042-111-000-674

- Email: info@psic.gop.pk

- Website: www.psic.gop.pk

Final Words

The CM Punjab Loan Scheme 2025 online apply process is a golden opportunity for the people of Punjab to start or expand their businesses without the burden of high interest rates. By applying in August 2025, eligible citizens can take advantage of this financial support to create employment and improve livelihoods.

Mein Punjab krza scheme se Khush hun

Panjab qrza sakeem ne mushkil asan kr di